Acknowledgement (ITR V) Download the ITR V and take a print out to keep a physical record with you. To download the ITR V go to " My Account " tab. Select the " View e-Filed Return/Forms " from the list. Choose " Income tax returns " and press the submit button. Click on the respective acknowledgement number. Then click on ITR -V in the download column. Have a look at the bottom of the acknowledgement, it says " DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU ". If it is not in your case, it means that you have not e-verified your income tax return successfully.

Posts

Online verification of ITR There are a number of ways to everify your return. Aadhaar OTP sent to your mobile number registered with Aadhar. EVC generated through Bank Account Number . Through Net Banking , generate EVC and verify your income tax return. EVC generated through Demat Account Number . Generate EVC through Bank ATM . Go to 'My Account' tab and click on 'E-Verify Return' from the drop-down menu. Choose one from the options found there. "Option 1: I already have an EVC to E-Verify my return." "Option 2: I do not have an EVC and I would like to generate EVC to E-Verify my return." "Option 3: I would like to generate Aadhaar OTP to E-Verify my return." 1. Online Verification of ITR through Aadhar OTP ITR e-verify through Aadhaar is an easy and simple way to do the job. A mobile number must be registered with Aadhar. Go for option 3 (mentioned above). Make sure that you have already entered your Aadhar number

Online Verification of Income Tax Return Choose one of the three options before the final submission of your return. E-verify now E-verify later ( within 120 days) Don't want to e-verify. E-verify now If you have already prevalidated your bank account or Demat account or having your mobile number registered with Aadhar and Aadhar number with the E-filing Portal, you can go with the option e-verify now. Therefore, you have to select the radio button against "I would like to everify". In this case, the e-verification process starts as soon as you submit your return. Thereafter, you need to select any one options from Aadhar OTP/ Bank Account/ net banking/ Demat account to verify your return online. E-verify later ( within 120 days) It is the second opinion, you will find, at the time of return submission. By selecting the option you can submit your income tax return online successfully. Moreover, the verification of the return can be done later on by genera

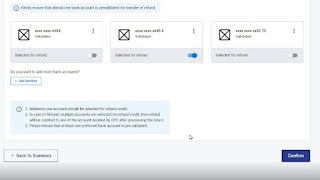

Fill income details After the selection of proper ITR Form, One need to fill each section of the form accurately. Here, you need to enter your income, savings and bank details. Income details: Annual salary/ pension, income from house property, income from Bank Interest, etc. Savings details: Annual savings and investments in LIC, PPF, NPS, ELSS, Medical Insurance etc. to claim tax rebate under sections from 80C to 80U. The system can automatically calculate your tax based on your inputs. Bank details Before online submission of your tax return, you have to provide your bank details too. Any refund for excess recovery of tax will be credited in this bank account. In this section of bank details, you have to make active at least one bank details.

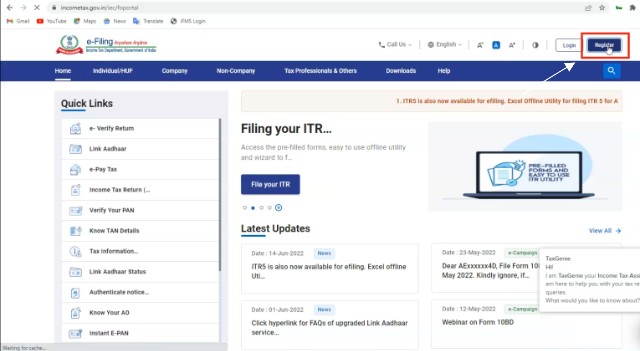

How to create login ID and Password for eFiling You need, at first, to get yourself registered on e-filing official portal to submit your IT Return online. This is a one-time registration process . Visit https://www.incometax.gov.in/iec/foportal/ and click Register . Here, you are asked to provide your Basic Details like name, PAN no., Date of birth, resident or NRI. The details should match your PAN database. Next, you need to fill the Contact Details along with mobile no., email and address in a registration form. After verify your OTPs received in mobile number as well as in email. After successful validation, you will have to create your login password. And also set your personal message. At last by clicking Register button your registration process will finish. Thus, you will get your user ID (your PAN no) and password (that you created in the process) for the efiling portal to log in. STEP1 STEP2 STEP3 STEP4 STEP5 STEP6

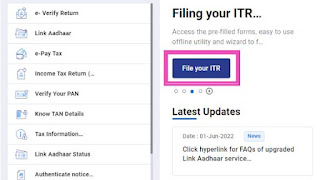

Log in to e-filing portal Visit the efiling portal https://www.incometax.gov.in/iec/ foportal/ Click on the button 'File your ITR' You have your PAN no. as user ID and password that you have already created at the time of registration. Login to e-Filing portal by entering user ID (PAN), Password, Captcha code and click 'Login'. First enter your PAN and click Continue button. There after tick the box for ' Please confirm your secure access message '. Next, enter your password and click Continue button again. Then on the next page click on File Now Select Assessment Year Select ITR Form Number Select Filing Type' as 'Original/Revised Return Select Submission Mode as 'Prepare and Submit Online

Income Tax Return Forms Income tax return forms or ITR forms are categorized in seven different forms. These are ITR1, ITR2, ITR3, ITR4, ITR5, ITR6 and ITR7. When you initiate to file your ITR, the first and foremost thing you have to do is to choose your ITR form accordingly. ITR-1 ITR Form 1 is applicable to those whose total annual income does not exceed Rs 5000000. And who earn their income by means of i) salary, wages or pension. ii) other sources like interest from SB or FD. iii) income from house property (not more than one). NB: If you are a salaried person having total income less than 50 lakh, you need to file ITR 1. ITR-2 ITR Form 2 applicable to when your income from salary or pension or wages exceeds rupees 50 lakh. It is also applicable to if you possess more than one house property and earn from those. Besides, to show your capital gains or losses, you need to file ITR 2. ITR-3 ITR Form 3 applicable to taxpayers who earned from business or profession or