Fill income details

After the selection of proper ITR Form, One need to fill each section of the form accurately. Here, you need to enter your income, savings and bank details.

- Income details: Annual salary/ pension, income from house property, income from Bank Interest, etc.

- Savings details: Annual savings and investments in LIC, PPF, NPS, ELSS, Medical Insurance etc. to claim tax rebate under sections from 80C to 80U.

The system can automatically calculate your tax based on your inputs.

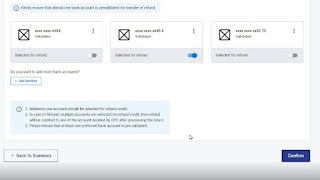

Bank details

Before online submission of your tax return, you have to provide your bank details too. Any refund for excess recovery of tax will be credited in this bank account. In this section of bank details, you have to make active at least one bank details.